Features

- Tax Profile Onboarding: Guided setup for filing status, state, dependents, and deduction preferences

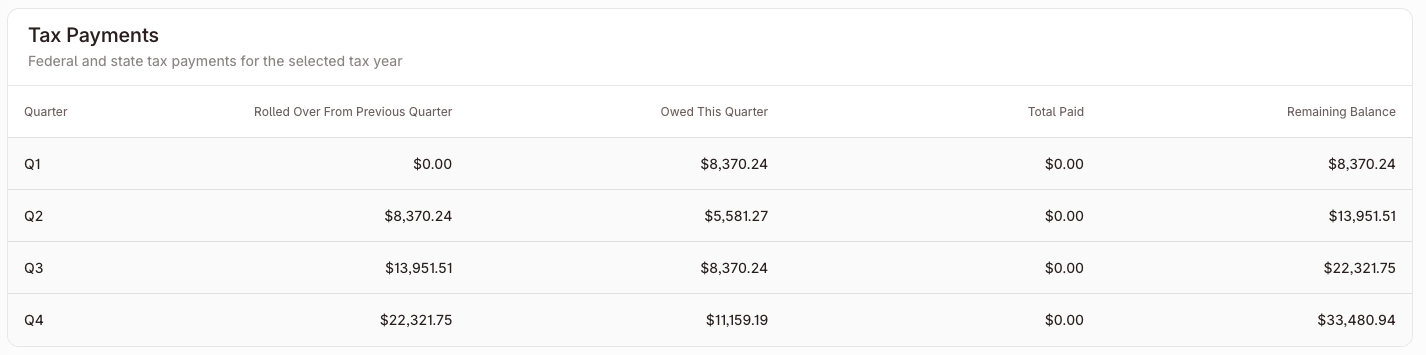

- Quarterly Estimates: Detailed breakdown of estimated federal and state taxes by quarter

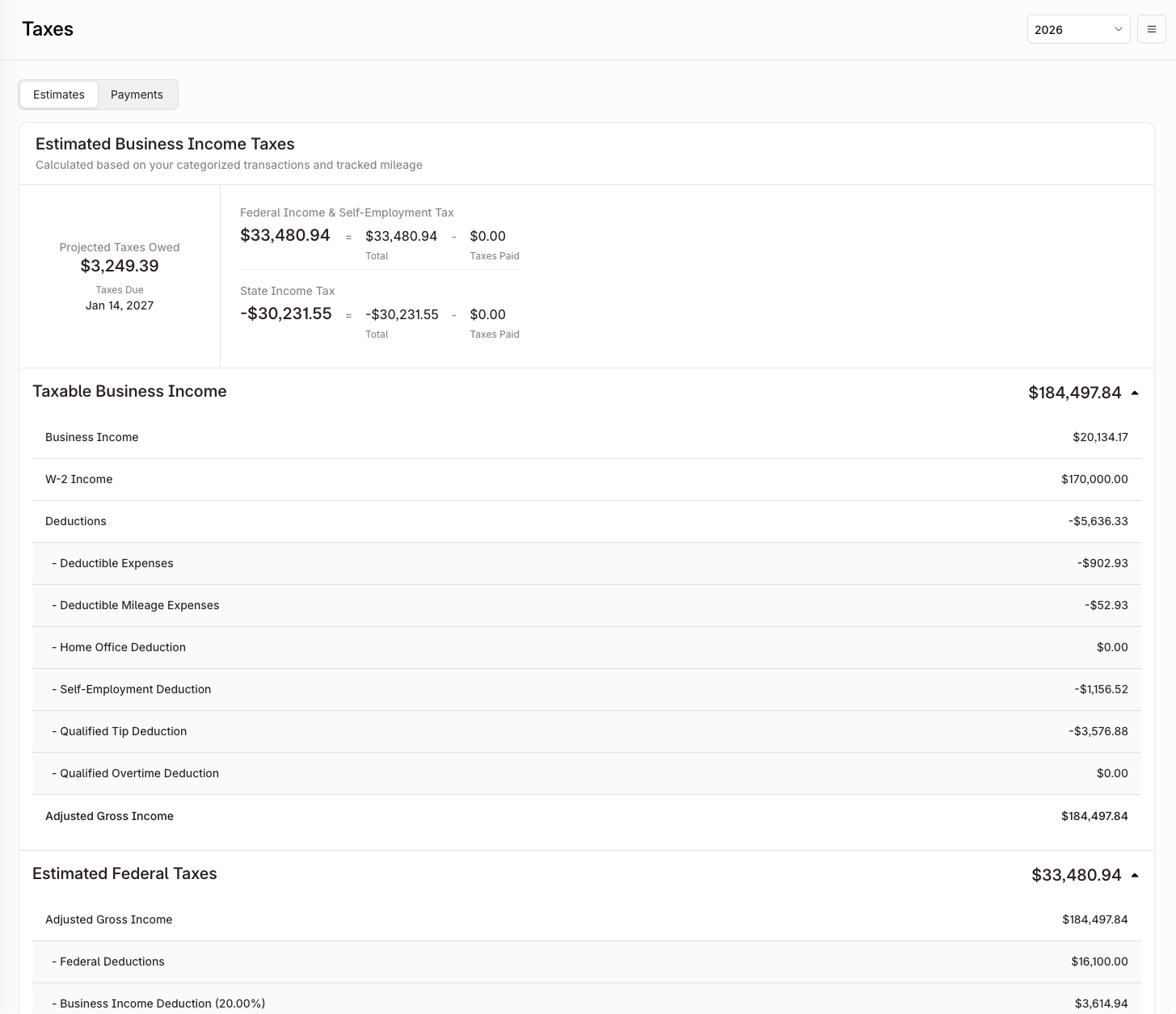

- Tax Calculations: Automatic calculation of taxable business income, adjusted gross income, and tax liabilities

- Payment Tracking: Record and track quarterly tax payments with due dates

- Year Selection: Navigate between tax years to view historical estimates and payments

- Expandable Details: Drill down into tax calculations including taxable income, federal taxes, and state taxes

Properties

The TaxEstimatesView component does not accept any props. All configuration and state management is handled internally.User Flow

First-Time Users (Not Onboarded)

New users see the Tax Profile form which collects:- Filing status (Single, Married Filing Jointly, Married Filing Separately, Head of Household)

- State of residence

- Number of dependents

- Standard vs. itemized deductions

- Estimated non-business income

- Additional estimated tax payments

Onboarded Users

Once onboarded, users see a tabbed interface: Estimates Tab - Summary card with total estimated taxes and expandable sections for:- Taxable Business Income (revenue, expenses, deductions)

- Estimated Federal Taxes (income tax, self-employment tax, quarterly estimates)

- Estimated State Taxes (state tax and quarterly estimates, if applicable)

- Payment quarter (Q1, Q2, Q3, Q4)

- Due dates

- Estimated amounts

- Federal and state breakdowns